Merrill Rewards for Business™ Visa Signature® card

Merrill Rewards for Business™ Visa Signature® card - Grow your business. Reap the rewards.

Merrill Rewards for Business™ Visa Signature® card provides liquidity to manage your business expenditures while earning rewards.

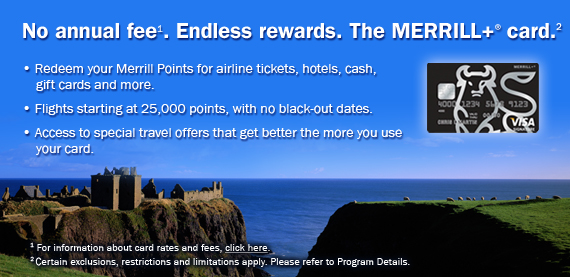

- No annual fee*

- Unlimited Cards for Employees

- 24/7 Concierge Service

- Terminated Employee Misuse Protection*

- Visa Signature benefits. Visit visa.com/signature for the most current offers.

Earn Rewards for Every Business Purchase

The Beyond Rewards® program offers maximum flexibility for how you can earn and redeem rewards points. Earn 1 point for every $1 in purchases and redeem your points for cash, gift cards and travel. Plus enjoy the convenience of redeeming your points for travel quickly and easily with our online travel booking service.

Make Your Workday Easier with Business Concierge Service

Save valuable time and resources with our premium business concierge service. From planning and booking your next business meeting to reserving a table at the finest restaurant in town for a client dinner, we're ready to assist you 24 hours a day, 7 days a week.

Experienced Service that Puts You First

While there are many business cards in the marketplace today, none come with Merrill Lynch's commitment to providing our clients with the highest level of service. No matter the inquiry, a highly knowledgeable service professional is always just a phone call away. Or access your account information online where you can manage payments, view statements, track activity, request a credit line increase, and add employees.

*Additional restrictions apply. Please refer to Program Details.

| Security Protection | Travel Protection | Where to Go if

There's a Problem |

||||

|---|---|---|---|---|---|---|

Our security promise to you

Merrill Lynch leads the way in addressing security and privacy concerns. Our financial services provide multiple layers of protection that include leading technology to protect your information on our computer systems, ongoing fraud monitoring to detect any unusual activity in your accounts, and responding quickly in an integrated manner to any reports of theft or fraud.

Your Merrill Lynch Card provides the complete protection you need. We not only take a determined approach in protecting you, but provide information to help you protect yourself and steps to take if you suspect there's a problem.

Merrill Lynch shares responsibility for protecting your privacy and personal information on our computer systems and we encourage you to protect yourself at home, at work - everywhere you go.

Zero Liability Protection

You are never held responsible for fraudulent charges to your card.

Terminated Employee Misuse Protection1

Protects you against eligible losses that might be incurred through card misuse by a terminated employee.

1Certain terms, conditions and exclusions apply.

Retail Protection1

Your account and purchases are protected with Purchase Security, which allows you to enjoy extended warranties on purchases, best value guarantees, and return protection.

1Certain terms, conditions and exclusions apply.

Purchase Security1

Purchase an item with your MERRILL+ Card, and within the first 90 days, replacement, repair or reimbursement is available in the event of theft or damage caused by fire, vandalism, accidentally discharged water and certain weather conditions. The maximum claim limit is $500 for eligible items of personal property. For more information, call 1.800.VISA.911 (847.2911).

1 Certain terms, conditions and exclusions apply.

Let us know when you're traveling

Unusual events that don't fit your profile such as transactions occurring in several countries in short succession may trigger a fraud alert. So please advise us of your travel dates and locations; it will reduce the chance that you will experience an interruption in service. Just call us at 1.800.MERRILL (637.7455) or contact your Financial Advisor.

3-Digit Code

On the back of your Merrill Lynch Visa® card you'll find a special 3-digit code (also called Cardholder Verification Value or CVV2) that you may be asked to provide if you're making a transaction online or on the phone. This safeguard measure ensures that you physically have your credit card with you and, in the event someone has stolen your card number (but not your actual physical card), they can't make any purchases.

Medical Emergency Assistance1

Provides medical referrals, monitoring, and follow-up when you or a loved one needs medical attention inside the U.S. and abroad.

1Certain terms, conditions and exclusions apply.

Lost Luggage Locator1

Helps you through the common carrier's claim procedures and can arrange for the shipment of replacement items.

1Certain terms, conditions and exclusions apply.

Car Rental Loss and Damage Insurance1

Reimbursement for the repair or replacement of a damaged or lost rental vehicle along with towing.

1Certain terms, conditions and exclusions apply.

Travel Tips

Traveler's Checklist

What to Do Before Going Abroad

- Photocopy your passport and driver's license and keep these separate from your travel documents. Photocopy the reverse side of your credit and debit cards, black out the card numbers, and record the card numbers to keep separately from the copies in a safe location. Give copies of everything to someone you can contact in case you need the information.

- Research passport and visa requirements, health and airline regulations and consulate locations.

- Make a list of all pertinent contact information, such as phone numbers for travel cancellations and car rentals. Include Merrill Lynch overseas contact numbers for lost or stolen cards, travel insurance benefits and customer service.

- Contact Merrill Lynch before you leave to advise of upcoming travel plans; this will help ensure your foreign charge transactions are accepted. Once overseas, should your charge be declined, call Merrill Lynch collect via the international operator. Telephone numbers are listed on the back of your card. Collect calls from hotels may incur a significant service charge, so consider using a pay phone.

- Convert your PIN to a four-digit number, as most foreign ATMs will not respond to PINs that are longer.

- Call Merrill Lynch to find out if charges on your credit or debit card will incur a foreign exchange transaction fee while you're abroad.

- Review all travel insurance terms and conditions carefully.

Reporting an Incident

If you suspect identity theft or fraud, it's important to act quickly so your financial institutions and law enforcement officials can respond accordingly. Please review the following steps to report an incident:

Step 1: Contact Merrill Lynch and other financial institutions.

- For Merrill Lynch, please call us at 1.866.617.1859 or contact your Financial Advisor.

- For other financial institutions, call your standard customer service number and ask to speak to the security and fraud department.

- They will take down your information over the phone. Also, make sure you request a fraud dispute form. It is critical you report identity theft and fraud in writing.

- Keep a log of all your calls, with whom you spoke and in what department (including the date and time of the call).

- When the matter is resolved, ask your financial institution to send you a letter stating that your account has been closed and discharged.

Step 2: Notify your other financial institutions.

- It is recommended that you make your other financial institutions aware of your identity theft, in case your problem is more widespread than you originally thought.

Step 3: Contact the three credit bureaus.

-

Contact each of the three credit reporting agencies to place a fraud alert:

- Equifax: 1.800.525.6285 or equifax.com

- Experian: 1.888.397.3742 or experian.com

- TransUnion: 1.800.680.7289 or transunion.com

Step 4: Notify the authorities about the theft/fraud.

- File a police report where you suspect the identity theft/fraud occurred.

- Ask to file a "miscellaneous incident" report. It is critical that you either obtain a copy of this report or get a copy of the report's number.

- File a report with the Federal Trade Commission (FTC), a government agency charged with protecting consumers. The FTC can share your theft report with law enforcement agencies for investigation purposes.

- Federal Trade Commission (consumer complaints):

1.877.ID.THEFT (438.4338) or consumer.gov/idtheft

- If your complaint is related to telemarketing fraud, contact your State Attorney General to report it.

Emergency Card Replacement

If you are alerted of a problem, or in the event of a lost card, we can have a new card in your hand within 24 hours. And, in most cases, we can also send emergency cash to you. Please call us at 1.866.617.1859 or contact your Financial Advisor.

Review the details of your Beyond Rewards® program

- Merrill Rewards for Business Program Rules

- Merrill Rewards for Business Partner Benefits

- Merrill Rewards for Business Insurance Benefits

PRODUCT DETAILS

What is the Merrill Rewards for Business™ Visa Signature® card?

The Merrill Rewards for Business™ Visa Signature® card is a Visa credit card designed for small to mid-size businesses that provides robust benefits, rewards and security features.What is the Annual Fee for the Merrill Rewards for Business™ Visa Signature® card?

There is no Annual Fee for the card.How do I apply for the Merrill Rewards for Business™ Visa Signature® card?

Please contact your Financial Advisor and request the card.How many cards can I have on an account?

There is no limit to the number of cards you can have per business credit card account. You can request 4 additional cards at the time of application. Once the account is approved additional employee cards can be added by having the guarantor or Authorized Contact call 1.866.617.1859.Can I get a card with just the company name?

No. Each Merrill Rewards for Business™ Visa Signature® card must have a cardholder name and the business name.What is the purpose of the Authorized Contact? Can there be more than one person designated?

The Authorized Contact is the person designated by the owner of the business to have access to all of the accounts. This can be an office manager, a secretary, anyone the business owner wishes to empower to manage their accounts. The Authorized Contact and Guarantor can make changes to the accounts - such as requesting a credit line increase, or adding new cardholders to the account.Why are there separate account numbers and credit lines for each employee?

Separate account numbers allow you to control employee spending and track expenditures by person. Additionally, if one person loses his or her card it does not affect everyone else in the business.How are spending limits set on employees' cards?

Guarantors and Authorized Contacts can set specific credit limits for their employees after the account has been enrolled on bankofamerica.com or by calling customer service at 1.866.617.1859. Employees' credit limits can be updated at any time.Can I withdraw cash from ATMs using the Merrill Rewards for Business™ Visa Signature® card?

Yes. You can use your assigned PIN (Personal Identification Number) to make withdrawals. This is considered a cash advance and is subject to a transaction fee and the card's prevailing cash advance rate.Do I need to have a Merrill Lynch brokerage account to apply for the Merrill Rewards for Business™ Visa Signature® card?

Although a brokerage account is not required, it is recommended in order to facilitate the underwriting process.Return to Top

BENEFITS AND REWARDS

Is there a limit to the number of Merrill Points I can accumulate?

No. There is no limit to the number of Merrill Points that can be accumulated with the Merrill Rewards for Business™ Visa Signature® card.How long do I have to redeem Merrill Points?

Merrill Points will not expire and will remain available for redemption as long as your account is open and in good standing. Please refer to your Program Details for additional information. Merrill Points can be redeemed online at card.ml.com or by calling 1.888.999.9645.Who earns the Merrill Points when cardholders spend?

By default, points automatically accrue to the business owner.What can Concierge help me with?

The Merrill Lynch Concierge is a free personal assistance service. Whatever you want, whenever you need it - whether it's dinner reservations or help getting an extra special gift - Merrill Lynch Concierge is standing by ready to arrange your requests. For example, Merrill Lynch Concierge can:- Arrange business meetings

- Plan business lunches

- Send creative gift baskets and flowers

- Get concert, sport and theater tickets

- Arrange for professional speakers

- Suggest, select and purchase unique gifts for any occasion

- Arrange spa appointments or golf tee times

Return to Top

STATEMENTS AND BILLING

How is each employee's spending reflected in my Merrill Rewards for Business™ Visa Signature® card statement?

An itemized listing of individual cardholder account activity since your last statement will be grouped by cardholder.Can I view my employees' Merrill Rewards for Business™ Visa Signature® card activity online?

Yes, the guarantor can view each cardholder's activity online once they enroll their account at bankofamerica.com.How do employees' access their activity?

Employees can enroll their card account at bankofamerica.com to view their card activity. Employees will not automatically receive statements on their individuals account unless requested through customer service after the account is set up.How can I pay my bills?

The Card is set up as corporate billing, meaning payments are made at the corporate account level - one payment account per company. You can send payments via US Mail with the remittance slip provided, online through their bankofamerica.com log-in, or by telephone by calling the Customer Satisfaction department:Mail Payments:

Merrill Lynch credit card customers should mail payments to:

P.O. Box 15710

Wilmington, DE 19886-5710

Overnight payments should be mailed to:

Payment Services

1000 Samoset Drive

Newark, DE 19713

Phone Payments:

1.866.617.1859

Online:

www.bankofamerica.com

Can the business remit one check to pay all of the accounts each month?

Yes.Can the statements be sent to different addresses?

No, there is only one statement that will only be sent to one address.Can I make payments at a Bank of America branch?

Yes.Return to Top

Banking products are provided by Bank of America, N.A. and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

Investment products:

MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of Bank of America Corporation.